XRP Price Prediction: Analyzing Investment Potential Amid Market Consolidation

#XRP

- Technical indicators show XRP consolidating near support with mildly bullish momentum signals

- Fundamental developments including ETF anticipation and regulatory clarity provide positive catalysts

- Analyst projections suggest significant upside potential while current levels offer favorable risk-reward ratios

XRP Price Prediction

Technical Analysis: XRP Shows Consolidation Pattern Near Key Support

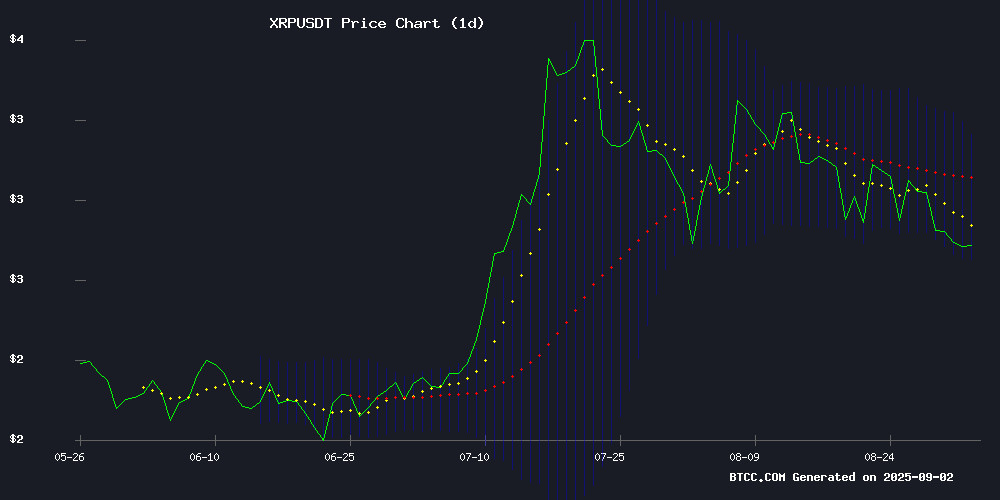

XRP is currently trading at $2.7759, slightly below its 20-day moving average of $2.9489, indicating short-term consolidation. The MACD reading of 0.1340 versus 0.1290 shows marginal bullish momentum with a positive histogram of 0.0050. According to BTCC financial analyst Mia, 'XRP is testing the lower Bollinger Band at $2.7116, which often serves as dynamic support. A hold above this level could signal potential upward movement toward the middle band at $2.9489.'

Market Sentiment: Cautious Optimism Amid ETF Speculation and Regulatory Developments

Current news FLOW surrounding XRP reflects mixed but generally positive sentiment. Multiple analysts are projecting significant price targets, with some suggesting potential rallies toward $27 based on Fibonacci and regression models. BTCC financial analyst Mia notes, 'The combination of ETF anticipation, regulatory clarity, and strategic advancements in cross-border payments creates a fundamentally supportive environment, though investors should remain aware of near-term volatility around current support levels.'

Factors Influencing XRP's Price

XRP ETF Anticipation and Remittix Growth Potential

The crypto market is abuzz with speculation over the potential approval of an XRP ETF, which analysts believe could drive Ripple's token above $4. WisdomTree and Franklin Templeton have filed applications, with a decision expected by October. Crypto lawyer John E. Deaton suggests that approval could unlock significant institutional inflows, providing XRP with liquidity comparable to Bitcoin ETFs.

Meanwhile, Remittix, a PayFi project, has raised over $23 million at $0.10 per token, attracting investors seeking exponential growth. While XRP's fate hinges on regulatory approval, Remittix is gaining traction through execution, with many viewing it as a more explosive opportunity than an XRP ETF.

XRP currently trades near $2.80, facing resistance at $3.10. Analysts caution that without ETF approval, the token may remain in consolidation. Whale activity, including the accumulation of 340 million XRP, has been noted, but sustained momentum beyond $4 likely depends on regulatory greenlighting.

XRP Price Analysis: Bulls Battle to Defend $2.80 Support Amid Market Uncertainty

XRP faces a critical juncture as traders scrutinize its ability to hold the $2.80 support level. Repeated tests of this threshold have left the market divided—while some see institutional adoption and cross-border settlement progress as long-term value drivers, others are fleeing to higher-volatility alternatives.

Technical charts suggest a breakdown below $2.80 could trigger a 25% plunge toward $2.20. Meanwhile, meme coins like Layer Brett siphon attention with their aggressive price action, highlighting XRP's current struggle to generate momentum.

Volume contraction exacerbates concerns. Despite Ripple's fundamental strengths, the token risks being overshadowed by speculative plays unless buyers can force a decisive rebound toward $3.30 resistance.

Coinbase Slips in XRP Holdings Ranking Amid Strategic Divergence

Coinbase's XRP reserves have plummeted 74% since July, dropping from 780 million to just 199 million tokens. The exchange now ranks 10th among top holders—behind Binance, Upbit, and Crypto.com—after a single whale moved 10 million XRP ($29M) off the platform.

While most major exchanges accumulate XRP following Ripple's SEC settlement, Coinbase's drawdown coincides with its BlackRock partnership. The Aladdin integration marks traditional finance's deepening crypto infrastructure ties, even as Coinbase reduces exposure to Ripple's token.

Analytics trackers suggest remaining reserves may represent retail holdings. The divergence highlights strategic forks in institutional crypto adoption—some embrace assets with regulatory clarity, while others prioritize ecosystem partnerships over individual token positions.

XRP Price Tests Key Support Levels as Analyst Outlines Bullish Scenario

XRP traded near $2.75 amid a 2.38% daily decline, with market participants closely monitoring critical technical levels identified by analyst Ali Martinez. The cryptocurrency faces a decisive moment between short-term downside risk and substantial upside potential.

Martinez's August 31 analysis emphasized the $2.77 level as a crucial support zone, warning that failure to hold could trigger a drop toward $2.40. Historical buying activity at this price point suggests it represents a make-or-break threshold for bullish momentum.

A subsequent September 1 update presented a more optimistic outlook, identifying $2.70 as the new defensive line and $2.90 as the breakout threshold. According to the analyst's chart patterns, a successful defense of support followed by a breach of resistance could propel XRP toward $3.70.

Market action reflected this technical tension, with XRP oscillating between $2.7034 and $2.8325 during the session. The price behavior demonstrates traders' responsiveness to these identified levels, creating visible battlegrounds for directional control.

Ripple and Stellar Advance Cross-Border Payment Solutions Through Strategic Pilots

Ripple has concluded a series of pilot tests with global banks, targeting enhancements in cross-border payment efficiency. The trials focused on cost reduction, transaction speed, and regulatory compliance, positioning Ripple as a viable solution for international settlements. Financial institutions participated in these preliminary assessments, which showcased Ripple's potential to optimize payment workflows without full-scale deployment.

Meanwhile, Stellar is driving financial interoperability in Africa by linking mobile money operators across Nigeria and neighboring regions. Its network reduces fragmentation among wallet platforms, creating a more unified ecosystem for digital transactions.

Crypto CEO Urges XRP Investors to Prepare Legal and Tax Structures Before Price Surge

As XRP price predictions reach optimistic heights, Digital Ascension Group CEO Jake Claver warns investors against complacency. "Wealth protection in crypto demands bespoke solutions," Claver asserts, emphasizing the need for customized trusts, LLCs, and custody arrangements tailored to digital assets.

The advice echoes broader industry concerns about crypto windfalls. Consultant Armando Pantoja's research suggests 18 months as the typical lifespan of unplanned crypto wealth. Both experts stress that structural preparation—not just price speculation—separates fleeting gains from enduring prosperity.

Legal frameworks take center stage in these warnings. Generic financial templates prove inadequate for addressing crypto-specific risks like regulatory uncertainty and security vulnerabilities. Proactive planning, Claver argues, must precede any potential XRP price breakout.

XRP Consolidation Phase Precedes Potential Rally to $27, Analyst Suggests

XRP is currently navigating a consolidation phase amid broader market declines, with five consecutive intraday losses marking its worst performance since June. The asset now trades at $2.73, having breached key psychological levels at $3, $2.9, and $2.8.

Market analyst EGRAG Crypto contends this downturn masks an impending bullish reversal. Using an inverted price chart, the analyst projects a speculative surge to $27—a stark contrast to current bearish sentiment. The prediction hinges on a decade-long trendline analysis, where XRP has oscillated between $0.3 and $0.7 for most of 2022 following the Terra collapse.

A defined consolidation channel—blue (support) and white (resistance) bands—continues to dictate price action. 'This isn’t a crash, it’s a coiled spring,' EGRAG remarked, emphasizing the asset’s historical resilience before major rallies.

Crypto Founder Explains XRP's Path to High Valuations Amid Market Stagnation

Versan Aljarrah, co-founder of Black Swan Capitalist, argues that XRP's potential for high valuations is more straightforward than market observers realize. Despite bullish catalysts—including the conclusion of Ripple's SEC lawsuit and growing institutional access via 401(k) offerings—XRP has failed to rally, currently trading at $2.80, well below its post-lawsuit peak of $3.60.

Aljarrah attributes the stagnation to XRP's engineered scalability and the absence of full regulatory clarity. "The token's value unlocks when institutions migrate," he noted on the Digital Outlook podcast, suggesting price suppression persists until adoption matures. XRP's infinite scalability theoretically removes price ceilings, but real-world hurdles remain.

Analyst Predicts XRP Could Reach $27 This Cycle Using Fibonacci and Regression Models

EGRAG, a prominent crypto analyst, asserts that XRP has yet to hit its peak in the current market cycle. Leveraging Fibonacci retracement levels and linear regression models, he projects a potential surge to $27 before the cycle concludes.

XRP's recent volatility has seen it climb to $3.66 in July 2025, only to retreat below $3 amid broader market corrections. Despite this, EGRAG remains bullish, citing historical patterns where the Lux Algo indicator's Blue X signal often precedes a false top, followed by a stronger rally to the true peak.

The analyst's chart analysis suggests that after a corrective phase, XRP could experience a significant upward push, mirroring past cycles. This pattern, devoid of a Blue X at the final top, reinforces his $27 target.

FindMining Unveils XRP Cloud Mining Strategy Promising $9,800 Daily Returns

FindMining has introduced a cloud mining contract strategy targeting XRP holders, offering a passive income channel with claimed daily returns of at least $9,800. The platform diverges from traditional Bitcoin and Ethereum mining by leveraging XRP's cross-border payment infrastructure, emphasizing low operational costs and automated smart contract settlements.

The model requires users to deposit XRP into designated addresses, with profits distributed in USD or XRP. While the offering has drawn industry attention, the sustainability of such high-yield claims remains untested in live market conditions.

XRP Gains Regulatory Clarity as GMO Miner Offers Stable Yields Amid Market Volatility

XRP's price volatility persists, with August 31, 2025, closing at $2.82—a 5.35% daily drop—yet the cryptocurrency stands at a pivotal regulatory juncture. The U.S. SEC's dismissal of its lawsuit against Ripple and confirmation of XRP's commodity status have fortified market sentiment, unlocking potential for institutional ETF investments.

GMO Miner capitalizes on this momentum, offering XRP holders a $6,800 daily yield through cloud mining. The platform's 'hold and yield' model bypasses hardware costs and contracts, appealing to investors seeking stability. With a $15 sign-up bonus and zero hidden fees, it merges accessibility with the asset's long-term growth prospects.

Is XRP a good investment?

Based on current technical and fundamental analysis, XRP presents a compelling investment case with measured risk. The cryptocurrency is trading near key support levels while maintaining positive momentum indicators. Fundamentally, the ecosystem benefits from growing institutional adoption through remittance solutions and potential ETF developments.

| Metric | Value | Interpretation |

|---|---|---|

| Current Price | $2.7759 | Testing support levels |

| 20-day MA | $2.9489 | Slight resistance overhead |

| MACD | 0.1340 | 0.1290 | 0.0050 | Marginally bullish |

| Bollinger Lower | $2.7116 | Key support level |

BTCC financial analyst Mia suggests, 'While short-term consolidation may continue, the combination of technical support and positive fundamental developments creates a favorable risk-reward ratio for medium to long-term investors.'